|

|

|

info@grayfoximages.com |

| Author's note: The viewpoint expressed herein is personal, speculative and derivative of publicly available technical information as well as suppositions expressed by observers. It does not contain or reflect any internal corporate knowledge. All linked material is referenced under fair use for educational purposes. Click on reference superscripts to access referenced sources. |

|

In The Mirrorless Conundrum, we discussed our initial thoughts on mirrorless interchangeable lens cameras -- especially Sony’s role in driving the MILC market segment, in no small part due to image sensor technology innovation. We reached the conclusion that, based on our personal use cases, the time for us to adopt mirrorless technology had not yet arrived, and we therefore compared digital single lens reflex camera offerings from Canon and Nikon relative to our personal interests -- concluding that Canon still best met our needs, albeit by a much narrower margin than when we switched from Minolta to Canon in 1999. But, now that Canon and Nikon have entered the

mirrorless fray with the EOS R and the Z6 and Z7 respectively -- and

granting that MILCs perform very well for landscape and other

non-action applications -- it’s time to

revisit the mirrorless question.

And, in the process we discuss the direction that digital camera sensor

technology is evolving as well as the capabilities that are

thus enabled. A Brief Sensor HistoryIn September of 2002, Canon introduced the 11 megapixel EOS 1Ds, the first professional grade full frame CMOS DSLR on the market. Most prior DSLRs, by all manufacturers, were APS-C crop factor cameras and were largely based on CCD technology. But, CMOS had technological advantages in power consumption, chip integration and fabrication costs,1 and today CMOS sensors2 are used for most traditional photographic applications. Having been an early adopter, Canon pushed to the front of the DSLR market, a position that it has not relinquished from a sales perspective -- although it is a mixed story when it comes to leadership in sensor technological innovation. Sony has moved ahead of Canon in dynamic range and sensor readout bandwidth with its Exmor line. Nikon, through its partnership with Sony for sensor manufacturing, shares that lead. A notable exception is Canon's dual pixel autofocus, a highly useful feature for video.

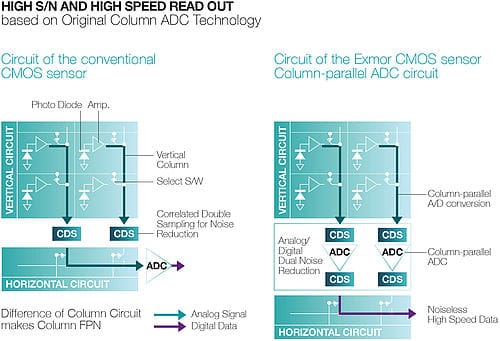

Source credit: https://www.edmundoptics.com/resources/application-notes/imaging/understanding-camera-sensors-for-machine-vision-applications/ Image credit: https://www.edmundoptics.com/contentassets/1e85009206814710980a5dea8810781f/fig-1-ucsmva-lg.jpg and https://www.edmundoptics.com/contentassets/1e85009206814710980a5dea8810781f/fig-4-ucs.gif One of the key innovations of

the Exmore line is on-chip analog-to-digital coversion. On-chip ADCs

increase dynamic range and reduce noise by removing the noise

susceptible external analog path from sensor chip to external ADCs.

In addition to on-sensor ADCs, Sony's Exmor sensor

technology also incorporated column parallel readouts. The column

parallel design greatly increases the readout speed possible from the light collecting

elements of the sensor. This unlocks

all sorts of high performance enhancements, including faster frame rates,

higher megapixel counts at those high frame rates, faster video

rates at higher and uncropped resolutions, more capable sensor-based autofocus,

blackout-free electronic viewfinders, etc. A

comparison of the two approaches appears in the Framos article,

What is Sony/s Exmor Technology Anyway?

Source credit:

https://www.framos.com/en/news/what-is-sony-s-exmor-technology-anyway Image credit:

https://www.framos.com/media/image/8b/61/4e/csm_exmor-figure1.jpg The reasons why Canon has fallen behind are hotly debated on Internet forums. A frequently offered explanation is that Canon deliberately restricts camera features to entice buyers to move upscale in the Canon line, at higher consumer costs and thus higher corporate profits. While there might be an element of truth in this supposition, it does seem a bit overly simplistic. One suspects most companies follow this practice to a greater or lesser degree.

Perhaps a more skeptical view might suggest that Canon has allowed its sensor technology to stagnate as it has exploited its position of initial leadership and market dominance (Canon’s current ILC market share is over 40% worldwide, twice its nearest competitor) to rake in immoderate profits, to the detriment of investment in continued sensor technology evolution. A possible example is the fact that Canon was very late in its introduction of sub-500nm circuit design. According to one source3, Canon APS sensors are produced at 180nm and full frames at 300nm. On-chip ADCs were also a very late Canon addition, a technology that Sony, and by extension, Nikon, had had for years prior. N

An additional factor is that the still photography market has been in a long period of decline, partly due to the rise of smartphones and partly due to market saturation as film cameras have disappeared and the initial wave of customer buy-in to digital cameras recedes into the past. All these developments have converged to leave Canon in a trailing position financially with respect to available sensor R&D funding. Sony Exmor R Backside IlluminationInitial Exmor sensors, like CMOS sensors from Canon and

others, were front-side illuminated, i.e. the wiring traces were on the

front, light collecting side of the sensor, reducing the sensor area (fill

factor)

available for photon capture.

However, in 2008 sony announced the Exmor R, a backside illuminated sensor

(BSI), wherein the wiring traces were behind the light sensitive

photodiodes, thus making almost the entire front area of each pixel

available for light collection. The increased fill factor available

for photon collection is illustrated in

Sony’s

2012 announcement of the Exmore RS BSI stacked sensor

(discussed next).

By moving to a BSI design, the Exmore R thereby increased the level of circuitry that could be packed onto the sensor and also the size of the light sensitive photon wells. Sony’s evolution was, in part, fueled by its leading role in manufacturing mobile phone camera sensors, a market not only lucrative in sales volume but also one requiring ultra high efficiency in the tiny sensor chips used in phone cameras. Perhaps Canon’s much more limited sensor manufacturing base could simply not generate the corporate revenues needed to stay ahead of Sony -- or perhaps Canon simply chose to invest elsewhere.

Sony Exmor RS Stacked BSIIn 2012, Sony announced Exmor RS technology, a

stacked sensor configuration for MILCs. The design included an additional processing layer bonded to the back

of the image data collection segment of the chip.

The latest version of the

Exmor RS incorporates a layer of DRAM buffer memory as a means of

facilitating internal sensor data transfer.

From Sony’s

2017

3-layer stacked Exmore RS announcement:

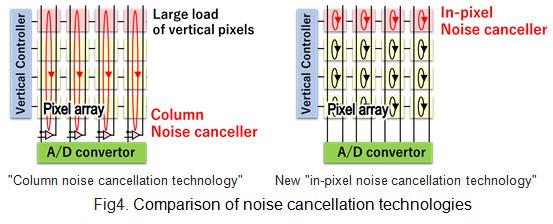

Stacked BSI sensors confer a number of advantages. Because more processing is done on-chip, there is less opportunity for noise to build up as is the case during external data transfers, resulting in lower noise and higher dynamic range (DR). Furthermore, processing latency is reduced. Sony sensors have reached the point where they are essentially ISO invariant -- that is conveying the ability to under expose a scene at a low ISO value and raise exposure in post processing without impacting image quality.6 In addition, the use of stacked sensor technology is understood to be one of the enablers for global electronic shutters, a feature with many benefits, as discussed in the next section. What Next?Tremendous progress has been made in camera sensor technology. However, there is yet more to be done. One of the foremost problems to be addressed next is the video phenomenon known as rolling shutter, the skewing of video images as the shutter traverses the image frame and as data is read out sequentially. The favored technological solution to rolling shutter is global electronic shutters -- the simultaneous exposure and subsequent highly parallel readout of the entire sensor at a very high refresh rate, thus not only solving the rolling shutter phenomenon but also obviating the need for mechanical shutters. Architecturally, global shutters require a far greater degree of parallelism, an example of which is shown in the diagram below illustrating in-pixel noise cancellation in a new Panasonic global shutter design.  Content source: https://news.panasonic.com/global/press/data/2018/02/en180214-2/en180214-2.html Image source: https://news.panasonic.com/global/press/data/2018/02/en180214-2/en180214-2-3.jpg In addition to removing rolling shutter artifacts, global shutters enable higher frame rates, higher resolution, lower noise, wider dynamic range and higher quantum efficiency.7 Sony is well situated with its stacked BSI Exmore RS sensor architecture to develop global shutters. Perhaps the ultimate expression of parallelism applied to the problem of global shutter operation was introduced by Sony in early 2018. The product, a 1.46MP stacked BSI CMOS sensor with global shutter, incorporated an ADC with each pixel. Power consumption is a problem for such massive parallelism, perhaps explaining the low resolution of this initial offering. However, it seems to point the way to the future.

Content source: https://image-sensors-world.blogspot.com/2018/02/sony-presents-gs-sensor-with-adc-per.html Image Source: https://4.bp.blogspot.com/-PSf3n28-GFo/WoMFi18L5fI/AAAAAAAAU64/SIM-alkVNTcnjPEvqk8Vjq-DTmGMaQg2ACLcBGAs/s1600/Sony%2Bimg01.jpg Rolling shutter video artifacts continue to characterize Canon’s DSLR and MILC offerings, a problem likely attributable to insufficient parallelism and on-chip processing in the image pipeline. Clearly it is in Canon's best interest to upgrade its sensor technology if it is to maintain market leadership. Canon's status and future direction are covered in the section that follows. Where is Canon?Canon eventually did move to 180nm technology and

finally began putting ADCs

on-chip with the introduction of the 1Dx Mark II in 2015. Prior to the

1DX MkII, Canon’s

sensors lagged Sony and Nikon in base ISO dynamic range by 2-3 stops.

Canon still trails by about one stop, but the gap has been

substantially narrowed and as a practical matter the difference is probably not significant in

most applications. Quite possibly Sony patents are constraining Canon’s design space for BSI and stacked sensor technology. Perhaps as a result, Canon has concentrated on dual pixel autofocus (DPAF), a highly effective approach to on-sensor phase detection autofocus (PDAF), a feature that has given Canon a strong position in video autofocus as well as a technology suitable for incorporation into mirrorless cameras. Other mirrorless cameras devote selected pixels within the sensor array to phase detection or possbily a hybrid combination of phase detection and contrast detection.9

Source credit: https://www.extremetech.com/electronics/160232-canon-70d-with-dual-pixel-cmos-af-the-first-dslr-that-can-autofocus-videos Image credit: https://www.extremetech.com/wp-content/uploads/2013/07/vcsPRAsset_513951_109512_6d82de1a-a274-4030-9c05-ea89cae2cb6c_0.png Canon has also experimented with extremely high MP sensors, e.g. the 120 MP APS-H (1.3 crop factor) demonstration sensor announced a few years ago. But Canon's sensor readout bottleneck remains despite on-chip ADCs, constraining a whole host of sensor capabilities. As a result, Canon cameras typically have cropped 4K video output and exhibit limited MILC frame rates compared to the competition. Canon's initial full frame offereing, the EOS R, also does not have sensor-based in-body image stabilization, a staple feature of Sony's product line for years, and now of Nikon's Z6 and Z7. Canon cites heat dissipation concerns for the absence of IBIS, but one can only surmise that the underlying lack of this desirable feature, which turns every non-IS lens into a stabilized lens, may have its origins in Canon's trailing position in stacked BSI sensor technology.

However, Canon is not standing still.

Especially critical is the vital area of sensor readout speed, a factor

which pervasively restricts Canon's CMOS sensors in high performance

features relative to the competition.

A number of patents in BSI and stacked

sensor technology and in global shutter technology have been filed.10

Canon also has patents for quad pixel autofocus sensors, which would improve

AF performance on horizontal patterns.11 These patents suggest that Canon will catch up. It does,

however, remain to be seen if and when Canon will finally deploy

these technologies in production products. And, needless to say,

others, Sony included, are not standing still. The evolution of

imaging sensors over the next few years -- and of the cameras using them -- will be

interesting to watch.

Image credits: https://www.canonnews.com/category/canon-patents-4 1 "CCD vs. CMOS", Teledyne DALSA Knowledge Center page. 2 "Imaging Electronics 101", Edmund Optics, Application Notes on Imaging 3 "The Sony A7R IV and what it means to Canon", Canon Rumors, 16 July 2019. 4 "Das Sensor-Dilemma", Foto+Design - Dr. Schuhmacher. 5 "Smartphones industry: Statistics & Facts", Statista.com 6 "ISO Invariance: What it is, and which cameras are ISO-less", Improve Photography. 7 "CMOS Global Shutter Cameras", Basler Knowledge Base. 8 "More sensor talk: Maybe a 32.5MP APS-C sensor is coming now. Canon News. 9 "Sony 4D AF versus Canon Dual Pixel AF", EOSHD, Andrew Reid, February 22, 2016 10 "Canon Patents", Canon News. 11 "Canon Patent Application: Quad Pixel Auto Focus sensor" Canon News. 12 "Sony Keeps Its Best Sensors for Its Own Cameras", PetaPixel, Michael Zhang, March 22, 2017 | ||||||||||||||||||||

© 2018 Michael W. Masters Return to top

|